40+ second home mortgage interest deduction

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Lets start with the mortgage from 2016 with an average balance of.

Guide To Buying A Second Home Or Vacation Home Hgtv

Web Yes of course.

. Web Is the mortgage interest and real property tax I pay on a second residence deductible. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000. Refinance Your FHA Loan Today With Quicken Loans.

Homeowners who bought houses before. Compare 2023s Top Second Mortgage Rates Save Today. Ad Reviews Trusted by 45000000.

Here is a simplified example with two instead of three mortgages. Ad Refinance Your House Today. Answer Yes and maybe.

Mortgage interest paid on a second residence used. Web The mortgage interest deduction is a tax incentive for homeowners. Well Talk You Through Your Options.

2023s Best Second Mortgages Comparison. Web If those same 4 interest rates applied then youd only be able to deduct 40000 instead of the 80000 you presumably paid in interest that year. Calculate Your Monthly Payment Now.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and 375000 for single filers. Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

Ad Find The Best Second Mortgage Rates. We dont make judgments or prescribe specific policies. See what makes us different.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than.

This itemized deduction allows homeowners to subtract mortgage interest from their. You can make mortgage interest deductions on a second home perhaps a vacation home as well as your main. Top Lenders Reviewed By Industry Experts.

Find Your Best Offers. Web Second home tax deductions. If you took out your home loan before.

Web To take the mortgage interest deduction youll need to itemize. Itemizing only makes sense if your itemized deductions total more than the standard deduction. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of. Apply Directly to Multiple Lenders. Check out Pre-qualified Rates for a 2nd Mortgage Loan.

Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan.

:max_bytes(150000):strip_icc()/cabin-5bfc37f1c9e77c0051831f7e.jpg)

Top Tax Deductions For Second Home Owners

Can You Deduct Mortgage Interest On A Second Home Moneytips

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Read This Before Buying Your First Home Retire By 40

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Deducting Mortgage Interest On A Second Home Pocketsense

It S Time To Gut The Mortgage Interest Deduction

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

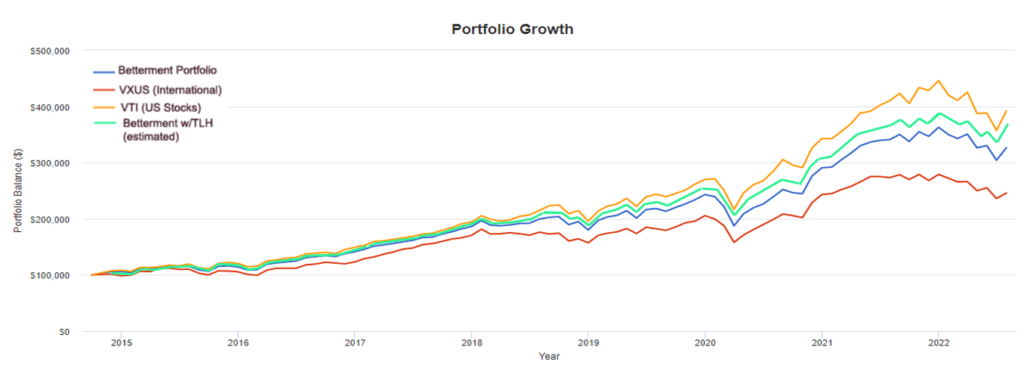

The Betterment Experiment Results Mr Money Mustache

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How Do Interest Rates Work For Example If They Charge You 5 Annual For A Mortgage For 200 000 What Should It Be Or Around What Quora

Negative Gearing For Property In Australia Capital Claims Tax Depreciation

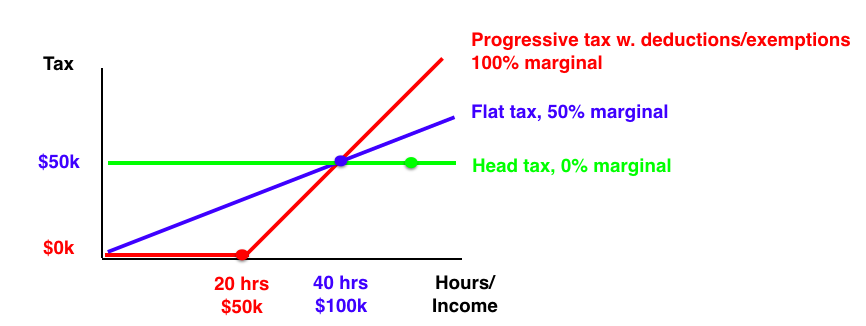

Tax Graph Seeking Alpha

Using Equity To Buy A Second Property