Sell put option calculator

5paisa Margin Calculator Is a simplified margin calculator that helps you calculated comprehensive span margin requirements for FO strategies while trading in cash currency commodity and FO before you proceed with your trade. If you put 2000.

Option Value Calculator Option Price Calculator Option Pricing Formula

Your directional bias concerning the underlying stock is bearish as the underlying stock going down makes the option you want to buy back cheaper which makes you a profit.

. Youll need to sell it and potentially lose money when youre ready to have kids and need a larger vehicle. I sell SPX puts at 65 delta with 1-4 days-to-expiration DTE. On the other hand the Put Option is also a contract that extends the right to sell an underlying asset at a particular price within a specific date.

That way the put will be assigned and youll end up owning the stock. When to buy the call option. Now this information can be highly important in helping you decide which option you should invest in.

Purchasing a put option is a way to hedge against the drop in the share price. If you expect the price of Reliance Industries to increase to Rs 2000. Facebook and Google reviews are harder to fake compared to 3rd party.

Expiry 31st December 2020. Fake reviews and even online video testimonials can be easily bought online. The Interactive Brokers Options Calculator and other software including but not limited to downloadable widgets provided by Interactive Brokers LLC IB for downloading the Software is provided for educational purposes only to assist you in learning about options and their theoretical fair value.

Can i trust online reviews for Sell House Fast companies. Careful planning and flexibility help. If out-of-the-money options are cheap theyre usually cheap for a reason.

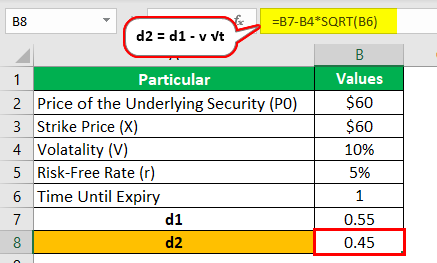

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option trader to know how the changes in these variables affect the option price or option premium. My put credit spreads treated me incredibly well over an 18 month span. This Bank NIFTY option strategy applies only to intraday trading.

Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze the Option Greeks. Before interest taxes and fees will be 15000 divided into equal monthly payments. Free quick and easy.

Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Pick the point at which you will commence your strategy. However the investor is not obligated to do so.

The premium received for the put you sell will lower the cost basis on the stock you want to buy. The Individual plan costs 099 per unit sold and the Professional plan costs 3999 per month no matter how many units you sell. Put is an option contract that gives you the right but not the obligation to sell the underlying asset at a predetermined price before at the time of expiry.

The Option Greeks sensitivity measures capture the extent of risk related to options trading. Heres what you need to know about selling and buying a house simultaneously. When you sell a put option with.

Why will you buy Reliance shares at Rs 2000 from the seller if you can buy it. So in the above call option example. However it is not mandatory to carry it out.

Lot Size 505 shares. Strike price Rs 2000. News World Reports Car Lease Calculator to estimate your monthly lease payments.

Franklin Street Suite 1200 Chicago IL 60606. Firstly chart a 5-minute Candle Chart in your charting software. So far we have assumed that you are currently opening a new trade using the current option prices.

If the stock doesnt make a bearish move by expiration you still keep the premium for selling the put. Naturally youll want the stock to rise in the long-term. When I open that position Ill enter a limit buy to close order at 70 profit 30 of premium.

Both call and put options can be either in the money or out of the money. For example if underlying price is 3615 you can exercise the put option and sell the underlying security at the strike price 4000. Copies of this document may be obtained from your broker from any exchange on which options are traded or by contacting The Options Clearing Corporation 125 S.

Option premium Rs 5715. So even if the stock price declines on a put option they can avoid further loss. It includes the Excel calculator xlsx and comes with a 27-page detailed PDF tutorial on how to use it to value stocks and calculate option premium returns as well as a 30-page booklet that shows readers which types of stocks and options are good for selling options on along with over 50 examples of stocks and ETFs that are great.

Use the Probability Calculator to help you form an opinion on your options chances of. Call Option is essentially a contract that extends the right to buy an underlying asset at a particular price within a given date. Please do not take mention of any company below as an endorsement or recommendation.

To enter the purchase price simply click on the option to open the option menu. When you sell a call option with the intention to buy it back later for a lower price you have a short call position. You can immediately buy it back on the market for 3615 realizing a profit of 40 3615 385 per share or 385 per option contract.

The investor who bought the put option has the right to sell the stock to the writer for their agreed-upon price until the time frame ends. The reason for cancelling the contract is simple. Check your strategy with Ally Invest tools.

Amazon also charges a referral fee for each item sold which is a percentage of the total sale price. Common Sell House Fast Questions Answers. If you already bought an option and want to see what the profit and loss looks like for your specific position you can input the purchase price of the option.

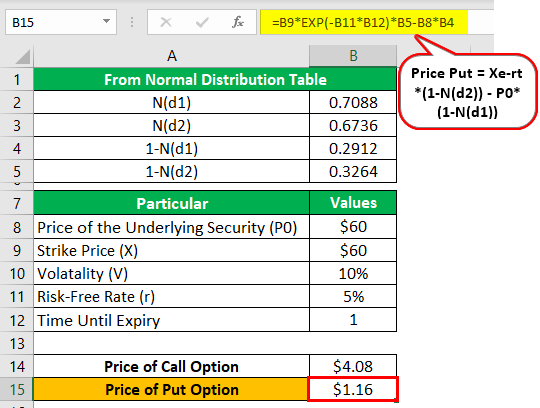

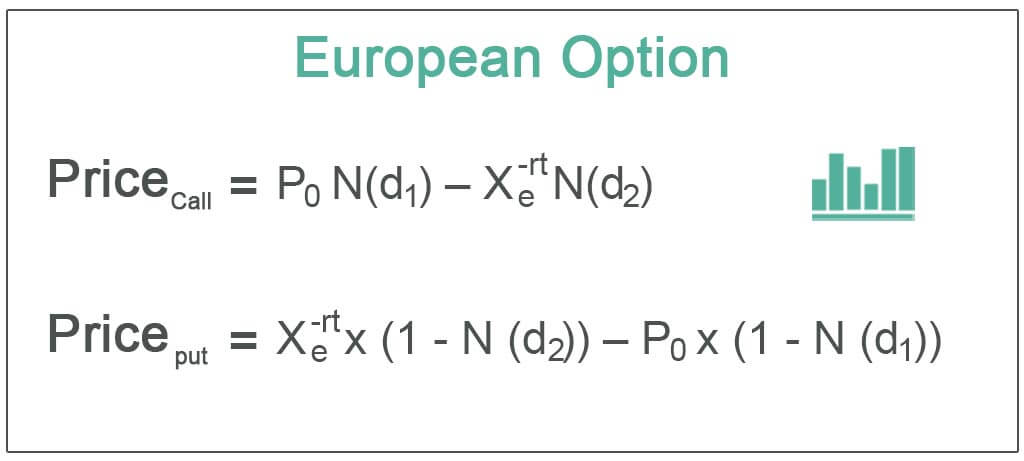

European Option Definition Examples Pricing Formula With Calculations

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-04-3d62440d22b8498684ee7f7773b52c07.jpg)

Options Basics How To Pick The Right Strike Price

What Is Call Option And Put Option A Beginner S Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

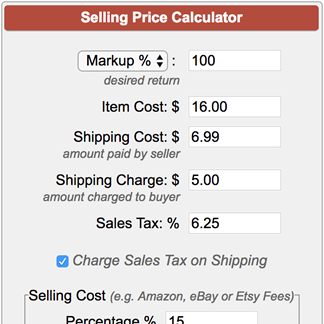

Selling Price Calculator

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Call Option Calculator Put Option

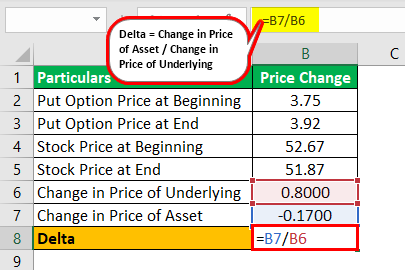

Delta Formula Definition Example Step By Step Guide To Calculate Delta

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

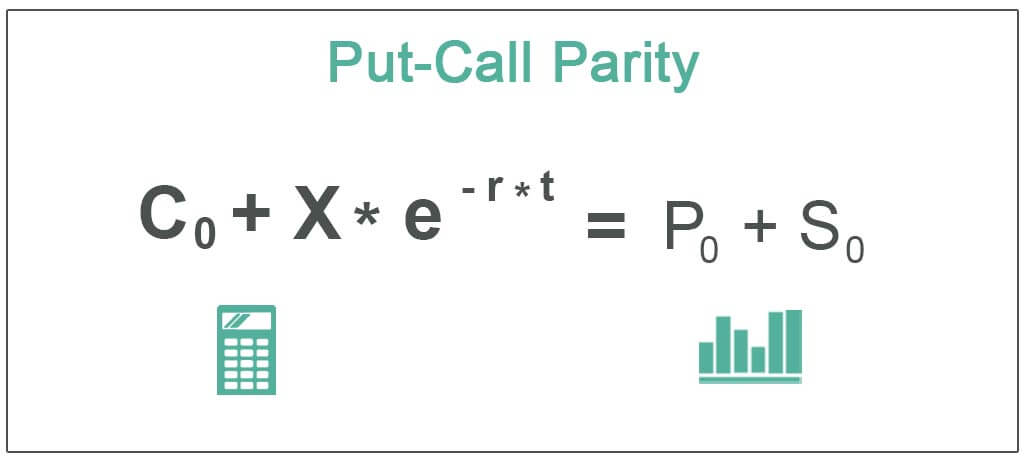

Put Call Parity Meaning Examples How Does It Work

How And Why Interest Rates Affect Options

Options Buying Vs Selling Which Strategy To Use Trade Brains

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Understanding The Binomial Option Pricing Model

European Option Definition Examples Pricing Formula With Calculations